support@debtdemolition.net

For Everyday Individuals Struggling to Break Free from the Debt Cycle

The Costly Mistakes Keeping You in Debt and How to Reclaim Your Financial Freedom in 12 Months

Without resorting to high-interest payday loans, complicated budgeting systems, or feeling like you’re sacrificing every joy in life. The Debt Demolition Roadmap is your step-by-step guide to eliminating debt, saving thousands in interest, and finally achieving financial peace of mind.

4.8/5 based on 342 reviews

Michael Jennings

This book is a must-read for anyone drowning in debt. It breaks down complex financial concepts into simple, actionable steps. I especially appreciated the section on tackling payday loans and high-interest credit cards—it gave me hope and a clear plan to turn things around. Highly recommended!

INTRODUCING THE DEBT DEMOLITION ROADMAP

77% of People Struggle With Debt While Paying 24% APR or Higher - Break Free Today!

Is Your Bank Really Helping You Escape Debt?

Every year, millions of hardworking people lose more money than they realize—not through spending, but through the crushing weight of high-interest debt. With average credit card APRs soaring to 24.4% and inflation eroding the value of every dollar you earn, even making minimum payments can keep you trapped for decades.

While you struggle to keep up, banks profit from these systems, charging up to 30% APR on retail cards and collecting billions in fees. Worse yet, payday loans often trap borrowers with APRs as high as 400%.

This guide offers a proven alternative. Instead of letting debt control your life, learn strategies to eliminate it, save thousands in interest, and reclaim your financial future. With actionable steps that require no financial expertise, you’ll move from overwhelmed borrower to empowered achiever —without relying on gimmicks or high-risk solutions.

It’s time to stop being a victim of the system and start building real wealth on your terms.

Escape the 24.4% APR Trap

The average credit card APR is a staggering 24.4%, with some exceeding 30%. For many, paying just the minimum means decades of repayments, costing thousands in interest. This guide offers actionable strategies to eliminate your debt faster, saving you money while reclaiming your financial freedom.

Avoid the Payday Loan Pitfall

Payday loans might seem like a quick fix, but their APRs often exceed 400%, trapping 70% of borrowers in a cycle of reborrowing. This guide shows you sustainable, proven ways to manage financial emergencies and build an emergency fund so you can avoid predatory lending.

Stop Letting Banks Profit From Your Struggles

Banks use your debt to lend at high rates while giving you little in return. On average, they earn up to 10x what they offer in savings interest. This guide equips you with tools to reduce debt and take control of your finances, ensuring your money works for you—not the banks!

Take Control in Just Minutes a Week

Eliminating debt doesn’t have to consume your life. With simple steps like budgeting effectively and choosing the best payoff strategy, you can make meaningful progress in under 5 minutes a week. This guide breaks it all down into manageable, actionable tasks.

MORE THAN JUST A PDF

Knowledge is power.

Introducing your superpower...

Right after your purchase, you’ll receive the link to download the Debt Demolition Roadmap in just a few clicks!

Understanding the Debt Trap

This chapter will teach you:

- Part 1: How debt works and how it is designed to keep you in a debt trap

- Part 2: The problem with payday loans and why you should never take one

- Part 3: The emotional and psychological toll of debt

The Roadmap to Debt Freedom

This chapter will teach you:

- Part 1: How to take stock of your debt in a simple and concise way

- Part 2: How to create a sustainable budget that eliminates debt, builds strong financial habits and paves your path to financial independence

- Part 3: Understanding the Debt Snowball and Debt Avalanche methods - how it works and helping you choose which one is right for you

Proven Strategies for Debt Elimination

This chapter will teach you:

- Part 1: Helps you cut costs without sacrificing quality of life

- Part 2: How to boost your income with side hustles and freelance work

- Part 3: How to negotiate successfully with creditors, including a sample phone script to use to negotiate lower interest rates

- Part 4: How to avoid common debt pitfalls

Long Term Financial Habits

This chapter will teach you:

- Part 1: How to build and maintain an effective emergency fund

- Part 2: How to develop a debt-free mindset to finally break free of the debt cycle

- Part 3: How to continuously track and optimize your budget

- Part 4: How to start investing in your future

- Part 5: How to plan for big expenses without resorting to borrowing

- Part 6: How to get started on building generational wealth

Tools and Resources

This chapter will teach you:

- Part 1: Budgeting Apps to Stay on Track

- Part 2: Debt Payoff Calculators

- Part 3: Tools for Cutting Costs

- Part 4: Resources for Financial Literacy

- Part 5: Accountability and Support Networks

The Human Side of Debt Freedom

This chapter will teach you:

- Part 1: Discussing the emotional weight of debt

- Part 2: Showing you success stories of people transforming their lives by getting rid of debt

- Part 3: How to process and release the emotional burden of debt while focusing on positive financial change

- Part 4: How to start living a life of financial freedom

GET YOUR ROADMAP TO DEMOLISH YOUR DEBT TODAY WITH THE "DEBT DEMOLITION ROADMAP" FOR JUST $17!

4.8/5 based on 342 reviews

Exclusive Bonuses Just For YOU!

Along with the Course, get special bonuses that will turbocharge crushing your debt. These extras are designed to complement your learning and give you an edge. Act now to unlock these invaluable tools!

- BONUS 1: 30 Day Debt Crusher Challenge

Unlock the proven step-by-step system where small action each day will allow you to crush debt fast and take control of your money – all within 30 days!

- BONUS 2: 7 Hidden Money Hacks to Uncover Extra Cash & Crush Your Debt

A powerful guide packed with little-known strategies to uncover hidden cash, maximize savings, and accelerate your journey to a debt-free life!

- BONUS 3: Debt Demolition Roadmap Cheat Sheet

Get a cheat sheet that summarises the whole Debt Demolition Roadmap on 1 page – that you can refer to whenever you need.

REAL SUCCESS, REAL PEOPLE

Join Our Community of Success Stories

- Verified Review

Sophia Rivera

"Empowering and Practical"

“The Debt Demolition Roadmap” doesn’t just give advice; it offers a step-by-step blueprint to financial freedom. The debt snowball and avalanche methods were explained so well, and I finally feel like I can conquer my credit card debt. A fantastic guide for real people with real struggles.

- Verified Review

James Whitman

"Exactly What I Needed"

I’ve read countless books on money management, but this one stands out. The personal stories and realistic strategies made me feel seen and understood. If you’re overwhelmed by debt and tired of being told to “just budget better,” this is the book for you.

- Verified Review

Olivia Harper

"Clear, Concise, and Motivating"

From the first page, I felt like the author truly understood the emotional weight of debt. This isn’t just another finance book—it’s a guide to reclaiming your financial and emotional well-being. The advice on negotiating with creditors alone was worth the purchase.

- Verified Review

Emily Carter

"A Game Changer for Families"

Debt affects more than just finances—it impacts relationships and mental health. This book helped my family take control of our finances without feeling overwhelmed. The tools and techniques for creating a budget and avoiding debt traps were easy to follow. A lifesaver for anyone who wants to stop surviving and start thriving.

- Verified Review

Lauren Mitchell

"Debt-Free and Thriving!"

This book truly changed my life. I was skeptical at first, but the straightforward advice and practical strategies made all the difference. The section on avoiding payday loan traps opened my eyes to how much money I was losing. Thanks to this guide, I’m on track to be debt-free within two years.

- Verified Review

Ethan Brooks

"A Beacon of Hope"

“The Debt Demolition Roadmap” feels like a trusted friend guiding you through the toughest financial challenges. The author’s empathy and actionable advice make this book a gem. I now have a plan to manage my debt and feel empowered for the first time in years.

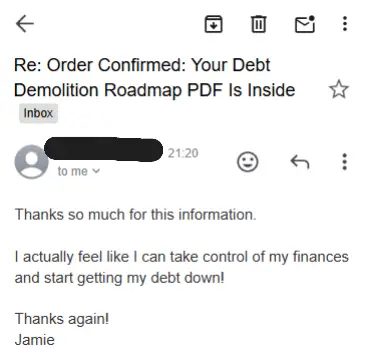

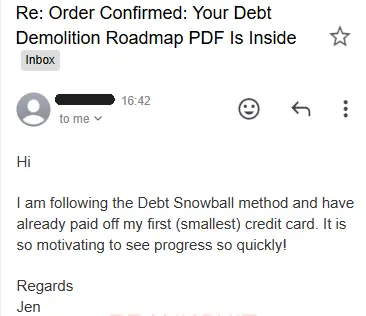

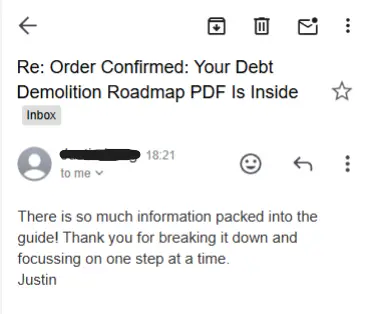

Want More? People Just Like You Send Us In This Every Day...

4.8/5 based on 342 reviews

READY TO GET STARTED?

Get The Debt Demolition Roadmap Today!

With this roadmap, you’ll gain immediate access to proven strategies to eliminate debt, escape the high-interest trap, and take control of your financial future. For a limited time, secure this life-changing guide at an unbeatable price. Don’t miss your chance to save thousands, reclaim your peace of mind, and join the growing movement of debt-free achievers.

DEBT DEMOLITION ROADMAP

Get the Debt Demolition Roadmap for only:

$37 USD

$17 USD

For a limited time only!

4.8/5 based on 342 reviews

Get the full 79 Page Debt Demolition Roadmap PDF immediately and take your first steps to become financially free in the next few minutes.

BONUS 2: 7 Hidden Money Hacks to Uncover Extra Cash & Crush Your Debt

A powerful guide packed with little-known strategies to uncover hidden cash, maximize savings, and accelerate your journey to a debt-free life!

BONUS 3: Debt Demolition Roadmap Cheat Sheet

Get a cheat sheet that summarises the whole Debt Demolition Roadmap on 1 page – that you can refer to whenever you need.

Still Got Questions?

Here Are The Answers

What exactly will this guide teach me?

This guide walks you through why traditional banking may be holding you back financially and introduces proven strategies the wealthy use to grow their wealth. You’ll learn step-by-step how to make smarter financial decisions, set up passive income streams, and protect your money from losing value over time.

Is this guide suitable for beginners?

Absolutely. We’ve designed it for anyone who wants to take control of their finances, whether you’re a complete beginner or have some investment experience. The guide explains everything in clear, simple terms with actionable steps anyone can follow.

Do I need a large amount of money to start?

Not at all! Many of the strategies we share are suitable for any budget. You’ll learn techniques that you can start with a small amount of money and grow over time.

How quickly can I see results?

Some changes, like avoiding hidden banking fees, can bring instant savings, while other wealth-building strategies work over time. With consistent action, you’ll likely see noticeable improvements within the first few months.

Will this guide work for me if I’m already investing?

Yes, definitely. This guide provides insights into strategies used by the top 1% and goes beyond basic investing. You’ll learn methods to enhance your current strategy and uncover areas where you might be losing money without realizing it.

How is this different from free advice I can find online?

Great question! This guide brings everything together in one place, with actionable steps and insider strategies that are often scattered across multiple sources. We’ve condensed years of financial wisdom into a single, easy-to-follow guide to save you time and effort.

Is there a guarantee if I’m not satisfied?

While we can’t offer refunds on digital products, we’re confident in the value this guide brings. The strategies inside are designed to help you save and grow your money—many users report getting more than their money’s worth within days of implementing the tips.

4.8/5 based on 342 reviews

All rights reserved – Debt Demolition Roadmap

Disclaimer

This guide is provided for informational purposes only and does not constitute financial, investment, or legal advice. The content is based on research and personal experience and is intended to share general information about financial concepts and strategies. Individual financial situations vary, and it’s important to consult a qualified financial advisor before making any investment or financial decisions. We do not guarantee specific results, and all investments carry risk. The creators and distributors of this guide are not responsible for any losses or damages resulting from actions taken based on its contents.